TL;DR

💪 Achieved $191M payment volume in 6 months

💪 Supporting 4.6K org with 105K+ transactions.

💪 Improved vendors' on-time payment request fulfillment rate by 13%.

💪 Boosted in-app payment, reducing CAC through virality.

💪 Reduced payment request processing time from ~2 days to 0.5-1h monthly.

💪 Real-time monitoring of scheduled payments and cashflow status led to less customer follow-up time; also eliminated time spent on manual reconciliation (matching names/amounts and depositing checks).

______________________________________________________________________

Background

Melio is an account payable tool designed for small businesses, which facilitated $20B in payments in 2021. It offers small businesses the ability to pay their vendors, suppliers, and contractors in a way that suits them, thus enhancing their cash flow and payment processes.

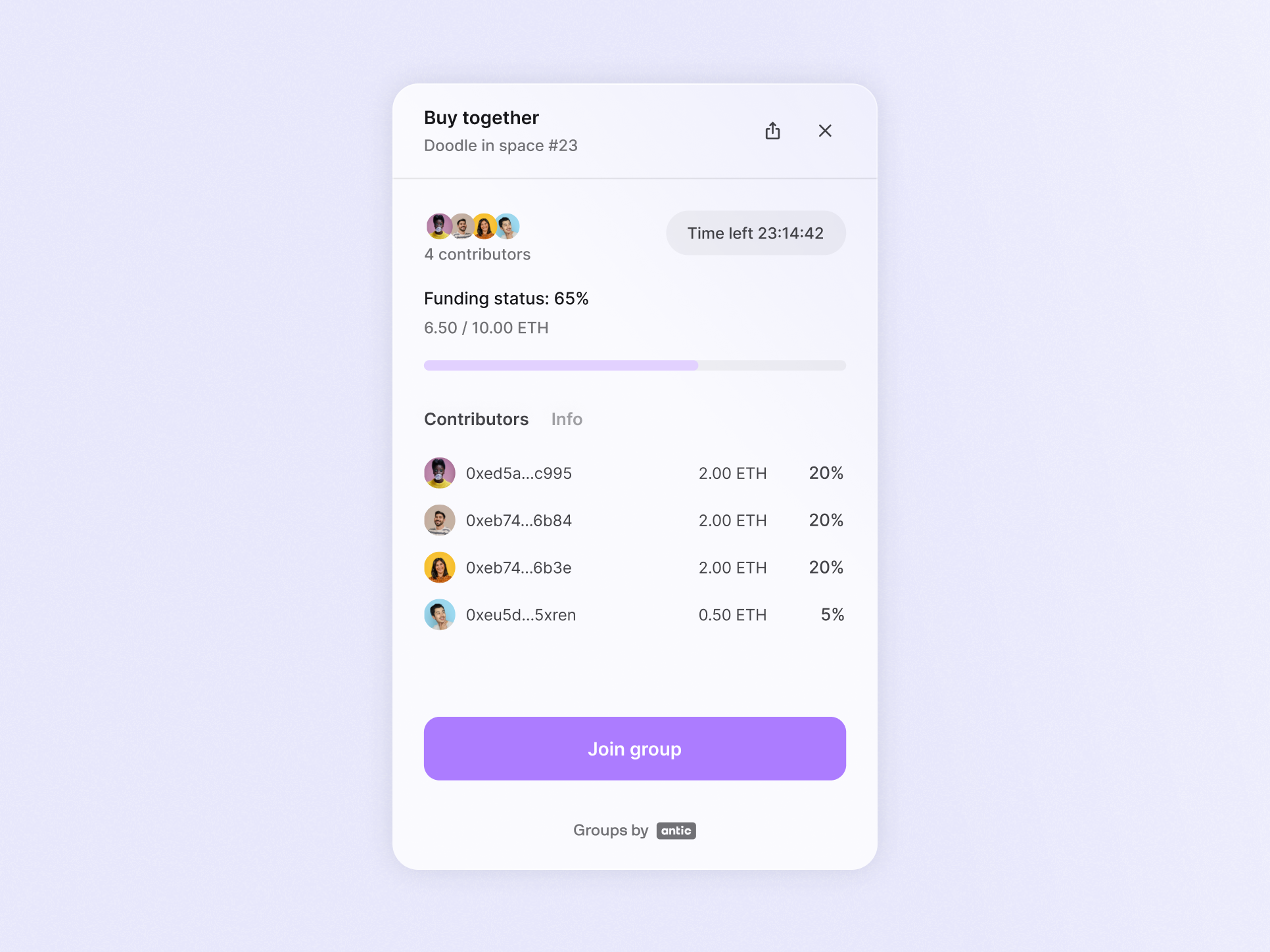

Until 2020, Melio only dealt with payments initiated by payers. But as we expanded, we saw the potential to improve our B2B payment system by allowing users to receive payments through our app. This would likely encourage more payers to use Melio for their payments as well.

The Challenge/goal

Design a solution that enables businesses to request, monitor and receive payments from other businesses using Melio.

Research

Discovery questions

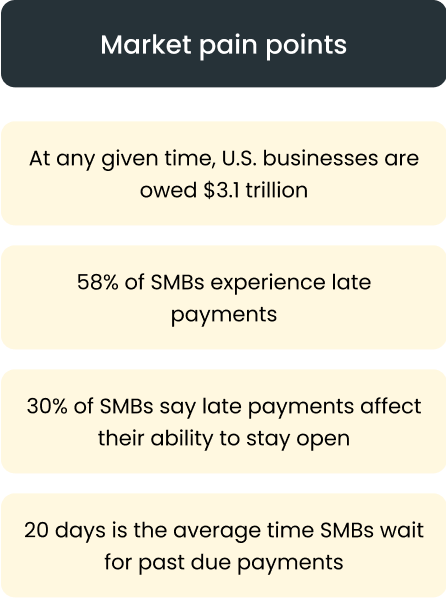

To create value for users who want to receive payments within the app, we explored SMB payment reception challenges and asked:

• How do SMBs currently manage payment requests?

• Who handles payment requests for SMBs?

• What are the main obstacles for SMBs when receiving payments?

The core user and market needs

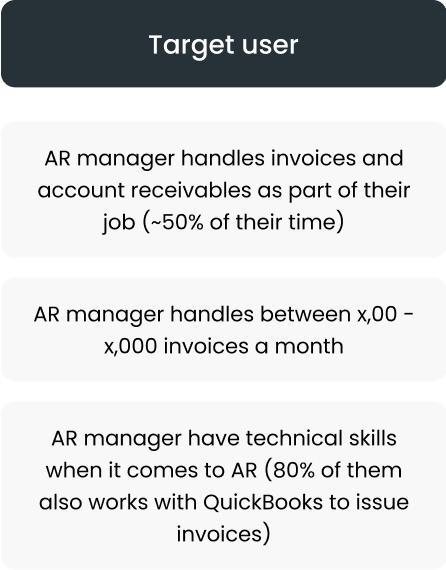

We discovered, through several interviews, market research, and internal research (from our CX and CS teams), that our right persona is the AR manager within a “large SMB”, and they have big pains when it comes to AR

Users' top 3 pain points

Insights

👉 The average AR user has the technical proficiency to collect payments.

👉 SMBs commonly use ACH transfers and paper checks due to the lack of affordable flexible payment options.

👉 Paper checks and bank transfers are slow, and insecure, and can lead to negative cash flow due to the uncertainty of fund arrival.

👉 Payment requests, monitoring, and reconciliation are significant manual tasks in payment processing, highlighting the potential for automation.

👉 Our virality-based vendor pipeline includes vendors that align with our target audience definition, highlighting the potential for effective marketing strategies leveraging our user base's network effects.

👉 Promoting Melio Get Paid can increase Melio Pay usage and virality, enabling outstanding invoice payments and enhancing the top company goals and KPIs.

Requirements

We used our research to create the MVP outline for Melio's Get Paid product with the aim of automating the payment processing tasks of SMBs. Our goal is to provide businesses with better control, improved cash flow, and reduced back-office work to allow them to focus on customer relationships.

Hypothesis

We believe that the Get Paid solution for AR managers will help to maximize SMBs' cash flow and minimize their time & effort. We will know we are successful when they will have an increase in overall payment fulfillment rate by their customers.

What would success look like?

We defined success and the # of paid payments initiated by payees.

Execution

Follow the invoice lifecycle

We mapped the invoice lifecycle into 3 linear parts and created them as tabs/sections:

Invoices - unsent payment requests

Requests - a way to ‘pulse-check’ with customers on scheduled payments

Payments - upcoming payments, processed, and paid payments (for ongoing monitoring)

Invoice lifecycle mapping

Full layout V1

Iterations and improvements

Early testers gave us very good input on how they interact with the platform, what value it can give them during the AR process, and what can be improved.

• The categories (data information) are not clear enough

• Some items are hidden by default, but users always filter to find them

• It tends to be hard to search and locate items

• For smaller SMBs, the new layout can be “too much” (compared to the AP product)

• Not available on mobile

Empathy map

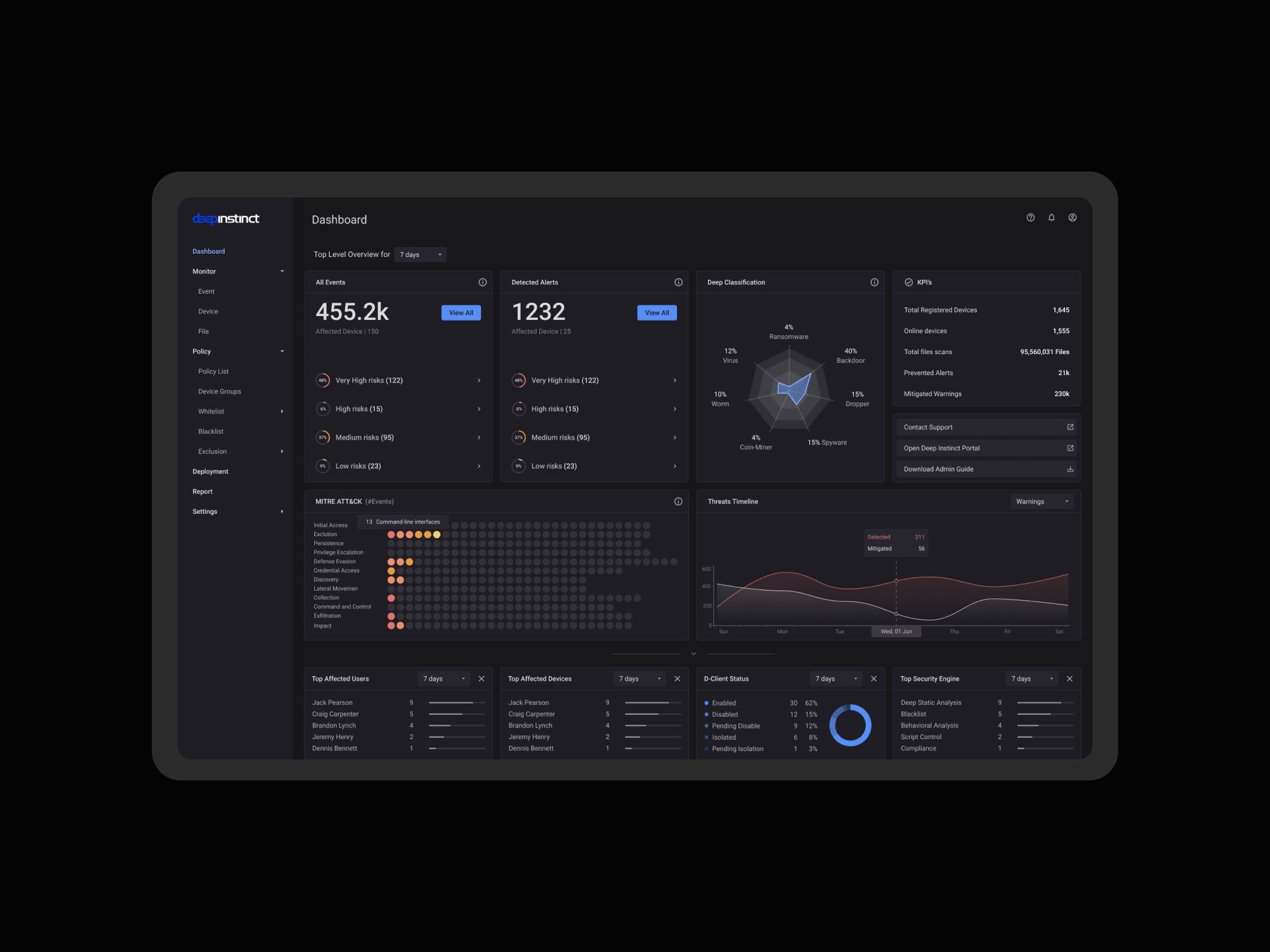

Based on feedback and internal testing, we made several improvements to our app, including:

1. Redefining the information architecture by creating four distinct sections for better navigation

2. Revising the naming conventions for each section to improve clarity and differentiation

3. Improving the app's overall usability by reducing screen space while maintaining functionality and ease of use.

Tabs name and logic improvement

Before and After

Market fit results

Analytics summary (6 months of data)

The new AR platform had high adoption rates among existing and new users, with

🙋🏻 365% MoM growth in active organizations (4.6K)

💰 267% MoM growth in payments (105K transactions)

⚡ $191M TPV (total payment volume) in 6 months.

It improved the payment request fulfillment rate by 13%, increased in-app payment volume through virality, and reduced payment processing time to 0.5-1h per month, providing better AR and cash flow management.